Introduction to Investments

Investments are considered as an asset acquired with a main objective of generating income or appreciating in value. Appreciation refers to increase in value of the asset over a period of time. The purpose of purchasing a good as an investment is not to consume it but to utilize it to generate wealth in the future.

Investments always require some form of capital today like time and money, with the belief that the future pay off will be more than what was invested. So, to say, an investor may purchase an asset with a certain amount of capital in hopes that it will generate income in the future or could be sold at a profit.

How does investment works

Investment can refer to any process which takes place with the goal of generating income or increasing in value over a certain period. These include purchase of stocks, bonds, or even real estate property. Furthermore, purchasing a property to set up manufacturing plant would also be considered as an investment.

Overall, any action that is made with the aim of creating wealth in the future can be considered as an investment. Even pursuing higher education, could also be considered an investment.

Since investment is focused on potential future growth, it has a certain degree of risk attached with it. Chances are that an investment may lose its value in the future or fail to generate income. This is what differentiates savings and investments; saving is accumulating money for future use which does not entail any risk, on the other hand, investment is using the money to potentially generate future income. So, it is quite possible that you invest in a company that ends ups becoming bankrupt.

Understanding portfolio investment

Portfolio investment is holding ownership of financial assets with a belief that it will increase in value or generate returns, or both. This involves a passive method of ownership as compared to direct investment which requires assuming a management position.

Portfolio investment could be categorised as

- Tactical, which requires active buying and selling in hopes of generating short term profits.

- Strategic investment involves acquiring monetary assets for their future growth potential, income yield, or both. This takes place with the motive of holding these assets for a long period of time.

Commodities, real estate, art, land, and gold which are physical investments are also included in a portfolio. In fact, portfolio investment can consist of any asset which is purchased with the purpose of generating income in short run or long run.

Getting to know Private Equity

Private Equity is ownership in a company which is not listed or open for trade to the public. This is a source of investments capital that usually comes from high-net-worth individuals and firms that acquire stake in private companies or control of public companies with the aim of making it a private firm and delist them from stock exchange. The private equity market consists of institutional investors and large private equity firms funded by recognized investors. Since private equity involves direct investment, which is done often to gain control of a company or influence its functioning they need a large amount of capital. Hence, we can see that firms with huge financial capability often dominate the private equity sector. The purpose of making such commitments is with the aim to achieve a positive return on investment. So, a private equity firm raises funds and manages the money to yield desirable returns for the shareholders usually within a period of 4-7yrs.

Venture capital

Venture capital is a form of private equity that investors offer to startup companies or small businesses that they believe have the potential to grow in the long run. Venture capital usually comes from high-net-worth investors, investment banks and other institutional investors. However, this always does not need to be in the form of financial capital. This could be provided as expertise in technology or management. Companies which are currently small and have a high growth potential and also the companies that grew rapidly and still head the same way are often presented with a venture capital.

The risk for investors who place their funds in venture capital is a high risk proposition. For new firms that have very limited history of operation, venture capital is becoming a very viable option for them to scale their business. The only downside for this could be that the investor usually gets equity in the company and does have a say in the firm’s decision-making process.

Other possible investment

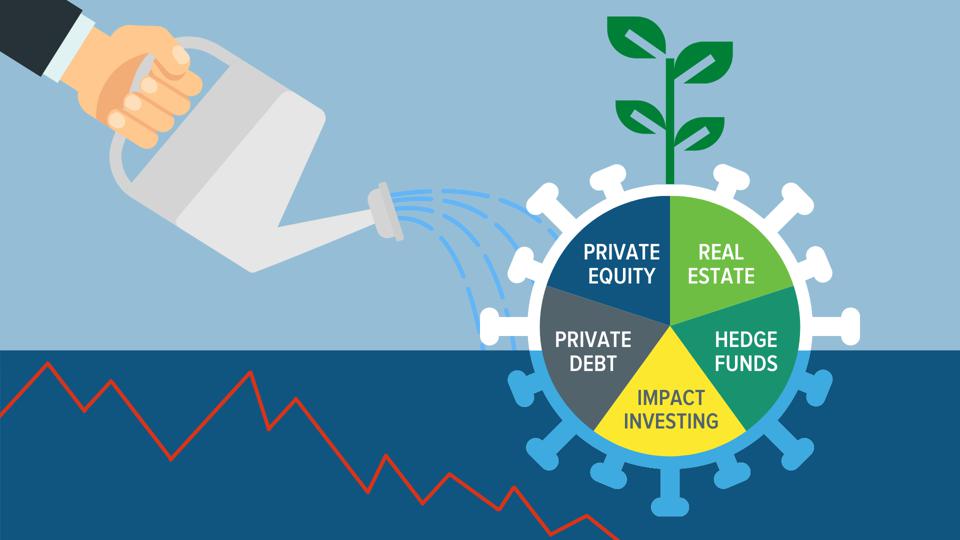

Investments other than stocks, bonds and private equity; venture capital as alternative investment can bring diversity to a financial portfolio. An alternative investment is such that it does not fall in the much traditional categories for investments. Traditional investments include stocks, cash, bond. Whereas alternative investments include hedge funds, commodities and derivates, art and antiquities, real estate is also considered as alternative investment.

How do investors benefit from alternative investment

Alternative investment has a low degree of correlation with traditional asset class. This makes it a desirable tool for diversifying a portfolio. Investment in gold, real-estate and hard assets can provide an edge against inflation. Even though alternative investment can be a risky option, the returns from the same could be exponentially high as well. Because of this fact, many institutional investors and individual investors have started to allocate around 10% of their portfolio for alternative investment.

You can also check the beginners guide to investing on Investopedia